Recommended reading: studying economics

I haven’t yet read Manias, Panics, and Crashes, published in 2000. But I came across a recommendation in the comments section of some blog the other day and found the title and the Amazon description rather intriguing:

“[Manias, Panics, and Crashes] is a scholarly account of the way that mismanagement of money and credit has led to financial explosions over the centuries.””“Richard Lambert, Financial Times

“This book sparkles with the best of Kindleberger’s wit, insight, and passion for financial history. A real delight.””“Robert Z. Aliber, Professor of International Economics and Finance, University of Chicago, Graduate School of Business

“What long has been the best history of financial pathologies is now even better. The reader who absorbs Kindleberger’s lessons will be prepared to foresee and navigate the financial crises that surely lie ahead. Like a true classic, Manias, Panics, and Crashes is both timely and timeless.” ”“Richard Sylla, Kaufman Professor of Financial History, Stern School of Business, New York University

“Foresee and navigate the financial crises that surely lie ahead”—ah, would that I had! Would that I could!

Book blurbs are often a literary form of “You scratch my back and I’ll scratch yours,” and as I said I’ve not read this one so I don’t know how good it actually is. But it occurs to me that some book or other on this topic ought to be required reading in our public school system. It might help to inoculate the public against falling for the mania part of the cycle (ah, a person can dream, can’t she?)

And speaking of economic education, even though I’ve noted before that economics is hardly my strong suit, one of the reasons I’m able to say that with some authority is that ecomonics was a required one-semester course in the New York City high school I attended so long ago.

Reflecting on that fact, however, I began to doubt my own memory. Could that really have been the case? It seems such an unusually rigorous requitement—so different from what I understand to be the curriculum of similar high schools today—that I began to doubt my own powers of recall.

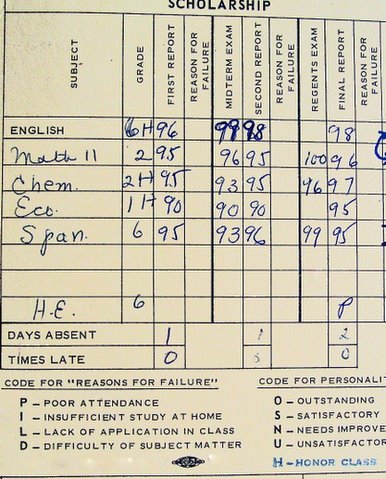

And so I decided to do some documentation in my own archives—in other words, the file cabinet in which for unknown reasons I have saved all my report cards. And lo and behold, fall semester of eleventh grade, there it was:

Note, please, the relatively low grades I received in the subject the first part of the semester. And even then, as I recall, the teacher was being very, very kind. I had no deep understanding of the topic at all, but I was able through memorization and spitting things back in a timely fashion to pull it off.

English, however—now that, I always aced. And I was no slouch in the math department, either. I humbly submit that I’m still rather conversant with English. But alas, eleventh grade math (and tenth, and twelth) has been totally erased by the passage of time. Can’t even remember what it was about, except trigonometry and advanced algebra definitely entered into it.

You stinky little grade-grubber. Booksy-snooksy!

Teacher’s Pet, too, I see.

What about your Spanish? If, say, you’d go vacationing in Dominican Rep would you be able to converse with the staff at the resort? Can you read books in Spanish?

It’s nice to have an Economy course in school, I guess, but based on my H.S. (so to say) experience in former Soviet Union, it is possible to politicize even such cut-and-dry subject as mathematics, let along Economy. And then Political Economy. And then Planned Economics. And the Theory of Scientific Communism…although that came later, in 3rd year of college.

vanderleun:

Yes, all your terrible accusations are only too true. Except the Teacher’s Pet one. I was actually a tiny bit rebellious in high school. My conduct grades (which you’ll notice do not appear in this photo of the report card) were not perfect. So there.

Although what passed for rebellious back then was utterly tame by today’s standards.

Tatyana: I can barely order off a Spanish menu, my Spanish is so poor. Another subject in which I actually did not shine, despite the goodish grades. But when in New York I can sometimes tune into what people are saying on the street in Spanish, if they don’t talk too fast and are saying something rather simple.

This makes me sad. I graduated from high school in ’96, having gone no farther than Algebra II (by my own poor choice) and even then recognizing that the school was not preparing us to do much of anything once we left. I can’t imagine what the schools look like now, as far as curriculum and standards. For that matter, I managed to attain a BA in PoliSci without taking any economics.

All of the useful stuff I’ve learned since then, frankly, and most of that in the Army.

Sig

vanderleun,

Your joking remark inevitably reminds me of Michael Palin’s prisoner-chained-to-the-dungeon-wall character in “Life of Brian”:

Jailer’s pet!

😉

More seriously, Neo, I’m impressed especially by how well you did in math.

Math was my favorite subject in high school; I was lucky to have some very fine teachers. And while I am anything but gifted in mathematics, at this stage of my life it constitutes one of my chief pleasures. Lately I have been teaching myself real analysis, and abstract higher algebra, and have found that there are few mathematical topics at this (moderately advanced) level that I can’t at least grapple with, and with great enjoyment.

But then, I am a weirdo generally.

Jamie Irons

Financial management is something totaly different from economy, more art than science. But now this is done by computer programs, and hardly anybody except their developers know how these damn things work! We are in unchartered waters now, so I am completely agnostic about present crisis.

After some careful analysis I’ve come to the conclusion that Neo has created this document. Long known to be clever with Photoshop, she’s done a Sarah Palin SAT scam on us, her loyal readers.

I’m reporting her to Gawker via the Dawn Patrol:

The Dawn Patrol

neo,

The way to avoid the mania part of any investment cycle in any asset class is to first bone up on Macroeconomics 101 and Microeconomics 101. Then, take a course in Money and Banking. Armed with those, then take any intro Finance course (making sure you also have handy some primer for statistics mathematics).

I realize that this is a formidable list for most people, but there really is no magic book you can take for an all-in-one-shot read.

Once you have the basics of economics and finance, then get a few books, or maybe just one good one, which educate about the Graham-Dodd value investing style. There are a lot of good ones out there.

The key to understanding value investing: buy good assets at significant discounts to their intrinsic value. In so doing, you insulate yourself from a lot of the downside risk. Understand what you own. It should be more than just a piece of paper. Understand the business itself, or at least the industry or asset class (in the case of real estate or residence or business property). By understanding what you own, you can then have a more realistic way of arriving at a meaningful range of intrinsic value of the asset. This is a moving target, based upon current conditions.

Armed with that range of intrinsic value, once that asset is starting to be priced on the market within that range of intrinsic value, YOU SELL IT. You don’t ride the tiger of mania. You sell it when the crowd is coming in the door. Pass it off to those who subscribe to the Greater Fool theory.

Then look for greener pastures, which typically are assets and situations where the crowd has left and the asset is selling at a significant discount to intrinsic value. But not every beaten down asset is a candidate for purchase. Some are taken out and shot because they truly are no longer good businesses, products, or business models. Separate the wheat from the chaff.

Successful investing is time and labor intensive. There are no short cuts. You have to commit your brain to a disciplined approach.

There is also a psychological aspect to investing also. You have to be disciplined over your own emotions. Really unflappable. I’m not kidding about this. It’s just a fact of life that some people are not made to do this sort of thing. You have to be studious and go against the crowd. You have to be willing to stay away from the herd.

These are good books on economics: Henry Hazlitt, Economics in one Lesson Ludwig von Mises Human Action

Kindleberger’s book is an absolute delight to read. Edward Chancellor’s (sp?) “Devil Take the Hindmost” is also excellent.

Investing 101

Bulls make money, bears make money, and pigs get

slaughtered.

When you are in the stock market, limit your losses (learn to love your losses…because you limited them) and when you see a profit, take it.

You must be a Bronx girl !

Norm

DeWitt Clinton ’65

When need arises, I found once learned language comes back with acceleration.

My foreign language in school was English; when I arrived in this country, first month was an absolute horror: I didn’t understand people on the street at all and on TV I could decipher only geographical names – and that because there was usually a map as background for a news anchor.

Then slowly single phrases became recognizable in solidly opaque flow, then more and more of them; after 4 months I risked to utter replies to a supermarket cashier.

Not that my English is not funny now, but the dam is broken and there is nothing to hold the current anymore!

I’m sure your Spanish would return if appears to be an absolutely necessary means for survival…just hope this will never happen.

Perhaps the schools need a lesson on the tulip bubble. with some down to earth way of demonstrating what a craze is.

New York State high schools still require one semester of Economics to graduate, usually in the senior year. (The other semester is “Participation in Government,” formerly known as Civics. ) My kids’ high school also offers Advanced Placement Economics.

We still have Regents’ exams, too. 100 on your Math Regents! Way to go, girl!!

The big big problem with Kindleberger’s book is that it lacks the why for these booms get started and then go bust.

Rothbard’s ‘America’s Great Depression’ is much more useful for understanding what we are going thru now, particularly if you skip the theory part (first part) and go directly to the narrative. Government interference is responsible for the boom and once it pops for prolonging the adjustment phase. I just finished rereading it and was a bit disturbed at the idiocies committed then that are being repeated now. Attempts to stop the adjustment process for wages and assets in general will make things worse.

When Government and/or banks and/or circumstances keep interest rates lower than the Market would set, and, however it is measured, inflation is perceived to be low or under control, and central banks then goose money supply growth, debt accumulation will accelerate at an unsustainable rate to unsustainable levels fueling higher economic growth rates in what seems to be a benign environment combined with higher unsustainable assets valuations. The subsidized interest rates will cause the capital structure to grow in ways it wouldn’t under normal sustainable conditions. When the debt levels reach a climax and assets values crash/bust, debt will be liquidated, causing a collapse in the money supply, and forcing shifts in capital structure as fuel (unsustainable) debt formation slows and then begins to collapse. The adjustment process is painful as capital is stranded, liquidated, and attempts made to salvage some of it. People, induced onto career paths no longer viable have to recover finding new occupations. Only after the Market as revalued remaining assets, debt is liquidated, and assets and people begin on more profitable trajectories can upward growth resume.

A simple analogy: A overly large building (stand in for an inflated standard of living based on unsustainable debt creation) is made from bricks. At some point more than half of the bricks are found to be faulty and turning to sand. Any attempt to save the structure is delusional and doomed to failure. The process of recovering the remaining good bricks and rebuilding a smaller scaled down building is time consuming, not to mention inconvenient, but the rational course to pursue.

Anyway,

An easier read and well worth the time is Henry Hazlitt’s ‘Economics in one Lesson’

As long as we’re recommending books, I found Thomas Sowell’s Basic Economics and the Friedmans’ Free to Choose good overviews.

Yeah, I know I still have a lot to learn, but I’m now better able to counter economic arguments from left leaning friends, especially when it comes to that scourge of The People, “greedy capitalists” vs our bestest friend who will keep us all from economic harm, the Government.

I’m a Nicholas Taleb Fooled By Randomness and The Black Swan guy myself. He hates economists.

While studying economics is always a good advice, I doubt that this can even a bit improve our understanding of the present financial crisis.

Frederic Bastiat’s The Law is another wonderful book.

This mess is less about basic economics than about finance and how it can be abused. I highly recommend “The Trillion Dollar Meltdown: Easy Money, High Rollers, and the Great Credit Crash” by Charles R. Morris for a clear discussion of how we got here.

I got a U in Works and Plays Well With Others.

Another nice recent book on economics – The logic of life : the rational economics of an irrational world / Tim Harford. Not technical at all, and a lot of fun (yes, it does seem odd to refer to an economics book as “fun”). He applies economic thinking to a lot of non-economic circumstances and finds that people are a lot more rational that you would think.

i don’t hav money on me and how can i studing economics with you there

howdy, perhaps this post may be a bit off topic but the point is, I have been searching your web site it looks truly tasteful..I’m developing a new blog and im sure hard-pressed to make it again appear great, and supply excellent content. I have learned a good deal here and I anticipate more updates and is going to be returning.